Green is the New Black: Why the GGRF Matters to Your Small Business

What if you could significantly reduce your operating costs? Then imagine if you could attract a new wave of environmentally

Understanding and preparing key forms is vital for a business loan, as they show your business's financial health and reliability, thus boosting loan approval chances.

Navigating the landscape of business financing can be a challenging process for small to medium-sized business (SMB) owners and CEOs. In an economic climate where growth is often fueled by smart investment and leveraged resources, having access to business loans can be crucial for operational expansion, purchasing equipment, and maintaining a healthy cash flow.

This article provides an in-depth exploration of the necessary forms and supporting documents involved in the business loan application process. Specifically, we will delve into asset-based loans with a particular focus on used equipment financing and equipment Sales and Leasebacks (SLB). Later, we’ll pivot towards key documents necessary for working capital loans.

Understanding the role of these supporting documents, their contents, and purposes can significantly enhance your loan application's success rate. After all, being well-prepared is half the battle when it comes to securing financing for your business. Let’s start our journey to better prepare you for your next business loan application.

In the realm of business finance, Equipment Financing and Sales and Leasebacks (SLB) are two popular asset-based loan strategies that SMBs regularly utilize. Equipment Financing pertains to loans specifically designed for the purchase of business-related equipment. This loan type enables businesses to distribute the cost of new equipment across a specified timeline, effectively managing cash flow and conserving capital for other operational needs.

Conversely, Sales and Leasebacks (SLB) entail a process where a business sells a previously owned asset—usually equipment—to a lender, and then leases it back. This mechanism liberates cash previously bound to assets, offering immediate working capital while retaining the use of the sold equipment. Both Equipment Financing and SLB can provide practical solutions to sustain operational efficacy and stimulate growth when utilized effectively.

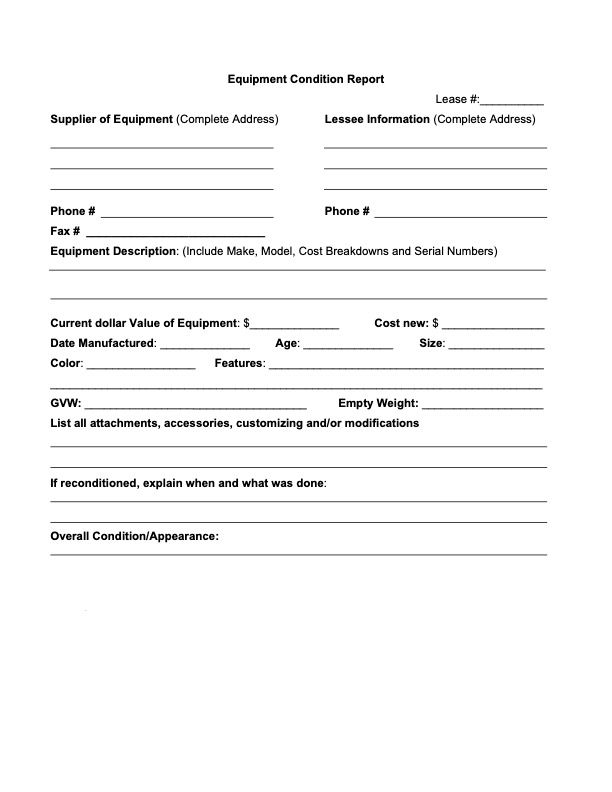

The Equipment Condition Report is a key document in the Equipment Financing and SLB procedures. This report furnishes an exhaustive evaluation of the equipment's physical and operational condition that is being financed or leased. It acts as a vital instrument for both the applicant and the lender to verify that the asset's valuation corresponds with the requested financing.

The Equipment Condition Report plays a vital role in loan applications as it equips lenders with an understanding of the asset's value and associated potential risks. This report usually encompasses details such as the equipment's age, degree of wear and tear, operational status, and repair needs. The level of detail in this report can profoundly influence the terms of the loan, marking it as a crucial element of the loan application process.

In a similar vein to the Equipment Condition Report, a Vehicle Condition Report fulfills a comparable role but is specifically oriented towards vehicles—be it commercial or pickups—that serve as titled equipment. This document imparts a detailed examination of the vehicle's present condition, its upkeep history, and future repair necessities.

The Vehicle Condition Report is indispensable to the application process for equipment financing or SLB that involves vehicles. It provides the lender with a holistic view of the vehicle's value, thereby impacting the decision about the loan amount, interest rate, and repayment conditions. The report usually comprises information about the vehicle’s mileage, body condition, tire status, and mechanical issues.

Just as with the Equipment Condition Report, a well-prepared Vehicle Condition Report can significantly bolster the lender's confidence, subsequently enhancing the prospects of loan approval. Rigorous preparation of these reports can simplify your loan application process, leading your business on the path to prosperity.

A Business Debt Schedule is a crucial document in the loan application process, serving as a comprehensive record of a company's existing liabilities. It provides a snapshot of the business's financial commitments, including details such as creditor names, nature of the debt, outstanding balances, monthly payment amounts, interest rates, and maturity dates.

In the context of loan applications, a Business Debt Schedule plays an essential role as it allows lenders to assess a company's current debt load and repayment capabilities. This assessment is a vital part of determining the business's ability to service additional debt and the risk associated with providing further credit. A well-prepared, up-to-date Business Debt Schedule enhances lenders' trust and can positively influence their decision-making process.

A Personal Financial Statement (PFS) is a document that outlines an individual's financial status at a given point in time. It is a comprehensive account of a person's assets, liabilities, income, and expenses. In the case of SMB owners, the PFS provides a snapshot of their personal financial health, separate from the business.

During loan applications, a Personal Financial Statement is often requested to evaluate the individual business owner's financial soundness, particularly in cases where the business owner has personally guaranteed the loan. The PFS includes critical elements such as personal assets (real estate, personal property, investments), personal liabilities (loans, credit card debts), income, and expenses. This evaluation gives lenders a holistic view of the business owner's financial position and ability to repay the loan.

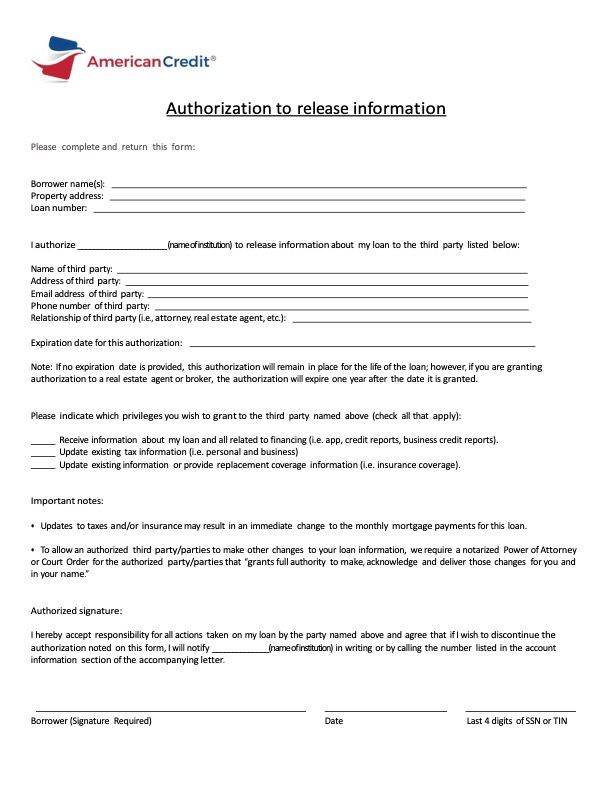

A Third-Party Release Form is a document that grants permission to disclose information to a third party. In a loan application process, this form enables lenders to verify information pertinent to the loan application with third parties, such as other financial institutions, accountants, or suppliers.

The Third-Party Release Form plays a crucial role in the loan application process as it allows the lender to get an accurate and complete understanding of the applicant's financial situation. Key elements contained in the form typically include the name of the third party, the type of information that can be disclosed, and the duration for which the release is valid. By allowing third-party verification, applicants demonstrate transparency and increase the chances of their loan application being approved.

Securing a business loan requires a thorough understanding of the relevant forms involved. From the Equipment and Vehicle Condition Reports to the Business Debt Schedule, Personal Financial Statement, and Third-Party Release Form, each document plays a significant role in demonstrating your business's financial health and reliability.

Remember, these forms are not merely bureaucratic procedures; they provide lenders with a window into your business operations and financial standing. A detailed and accurate preparation of these forms can enhance your chances of securing the financing you need. In conclusion, equip yourself with knowledge and pay meticulous attention to detail during the loan application process. This preparation will serve as a strong foundation for your journey to secure business financing and, ultimately, drive your business growth.

Sign up for the newsletter and get our latest stories delivered straight to your inbox.