Green is the New Black: Why the GGRF Matters to Your Small Business

What if you could significantly reduce your operating costs? Then imagine if you could attract a new wave of environmentally

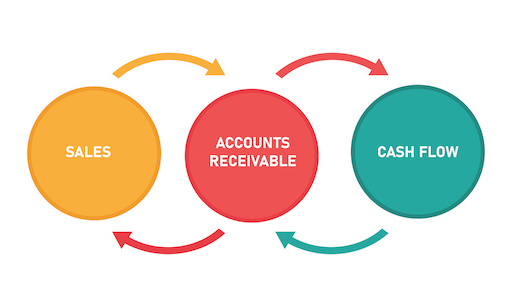

To run efficiently, businesses need a steady cash flow. However, sometimes cash flow becomes constricted due to unpaid invoices. In such cases, asset-based lending or invoice factoring can be a lifeline for your business, ensuring you keep your doors open and operations running smoothly.

Accounts receivable financing companies provide a lifeline to businesses caught in such cash flow dilemmas. AR financing, often called invoice factoring, is essentially a loan against your outstanding invoices, which serve as collateral. With the quick injection of cash, you can cover your business's operating expenses including payroll, rent, and inventory. This type of small business loan, therefore, helps you maintain your operations, whether you're a start-up or a long-standing business.

Here are some instances where accounts receivable financing can provide crucial support:

Unpaid invoices can leave you short of the necessary funds to cover your operating expenses. Invoice financing companies can lend you up to 80-90% of your outstanding invoice value, providing a cash flow solution that lets you cover crucial expenses. This method is valuable for both new and existing businesses, helping them navigate times of limited cash flow and continue their growth trajectory.

Finding a great deal on equipment or encountering a liquidation sale can be a boon for your business. But without cash flow, you might miss out. Invoice factoring companies can provide the needed funds within a day or two, enabling you to seize the opportunity instead of waiting for your invoices to be paid.

Payroll is one of the biggest expenses for a business. Delayed invoice payments can make it difficult to meet this commitment, potentially leading to legal complications and affecting employee morale. Invoice financing can help manage cash flow to ensure timely payroll, boosting productivity and potentially reducing turnover costs.

If your business experiences seasonal fluctuation or periods of lower activity, your cash flow may dip. An invoice financing company can help buffer your business during these slower times, providing access to earned yet outstanding revenue.

Having several large clients can result in significant outstanding invoices. This could leave you without a substantial amount of cash flow even after delivering the product or service. Invoice financing allows you to access the revenue you've earned but haven't yet received, enabling you to continue marketing, acquiring new clients, and covering operational expenses.

Don't miss out on new business opportunities due to waiting for invoices to get paid. AR financing can provide the necessary working capital to take on new clients and big jobs that could elevate your business. Invoice financing can provide the cash flow you need to grow your business while managing your bills and payroll expenses.

Invoice financing companies provide a lifeline for businesses experiencing a cash flow crunch. By converting your unpaid invoices into cash, you get immediate access to working capital, allowing your business to thrive in various circumstances. As a solution, AR financing offers free working capital that can benefit both new and existing businesses.

American Credit®, Inc website: amcredit.com

Sign up for the newsletter and get our latest stories delivered straight to your inbox.