Green is the New Black: Why the GGRF Matters to Your Small Business

What if you could significantly reduce your operating costs? Then imagine if you could attract a new wave of environmentally

Embark on a transformative journey into the heart of small business administration with our in-depth exploration of the SBA and its impact on entrepreneurs. In this comprehensive pretext, we pave the way for your understanding of everything SBA.

By Corey Rockafeler

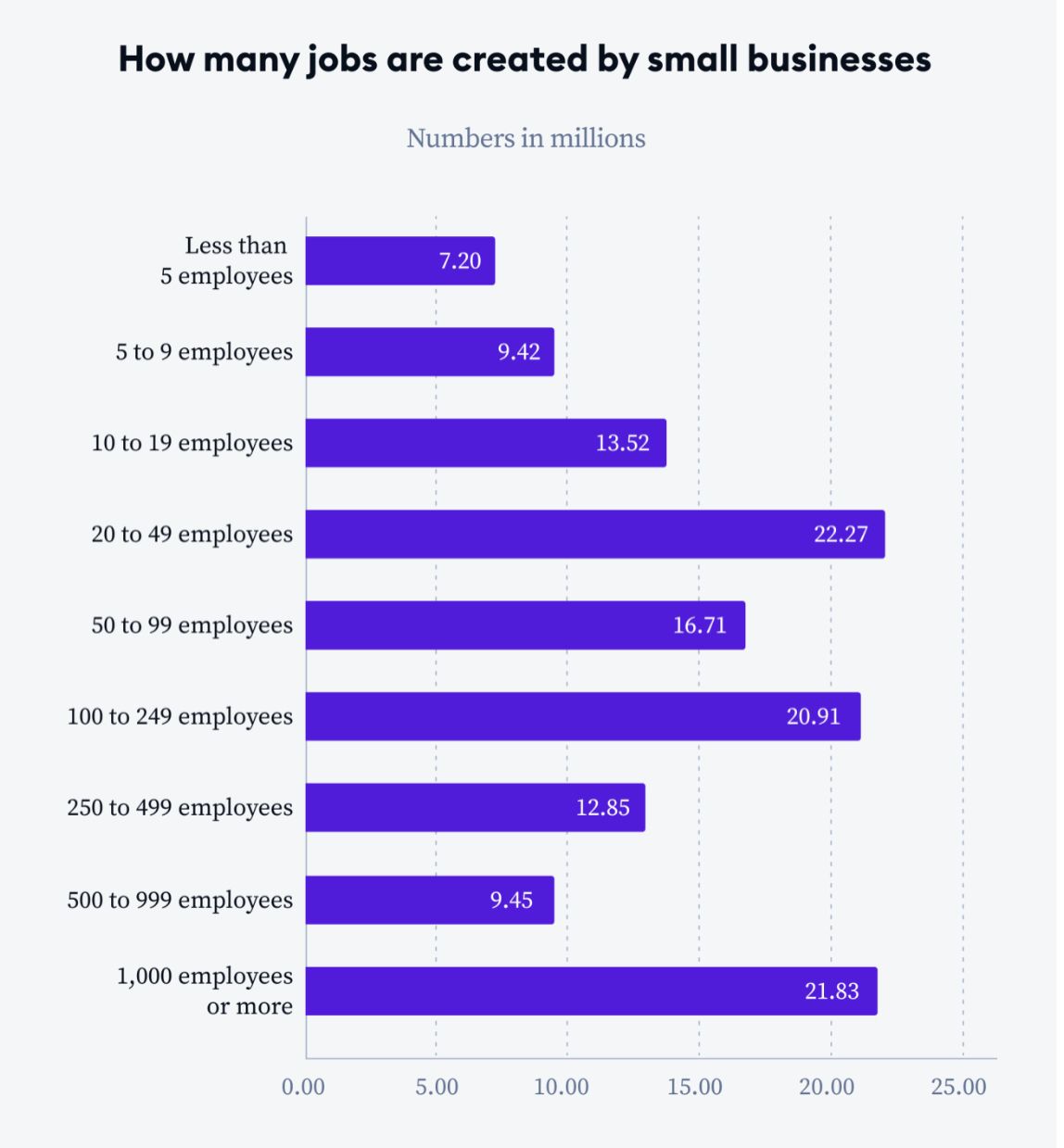

Today's dynamic economic landscape relies heavily on small businesses to drive innovation, create jobs, and foster local growth. Entrepreneurial enterprises are the backbone of the economy, providing jobs, GDP growth, and fostering a sense of entrepreneurship. From access to capital to navigating government regulations, running a small business can be challenging.

This is where the Small Business Administration (SBA) comes into play. Founded in 1953, the SBA is a federal agency dedicated to supporting and empowering small businesses. Providing access to resources, capital, and guidance for entrepreneurs and small business owners is its mission.

We will shed light on the critical role the Small Business Administration plays in helping small businesses succeed. You will also find information about its programs, services, and eligibility requirements. Whether you are a current small business owner seeking financial assistance or an aspiring entrepreneur looking for guidance, this is your go-to resource for navigating the world of small business and the SBA.

II. What is SBA-Small Business Administration?

SBA Mission and Definition

The Small Business Administration (SBA) is a United States government agency devoted to supporting and assisting small businesses. The organization facilitates small business growth and success through access to capital, entrepreneurial development programs, and government contracting.

SBA advocates on behalf of small businesses to ensure they compete fairly in the market. By fostering entrepreneurship, innovation, and economic resilience, it promotes economic growth. Small business owners can access resources, guidance, and support tailored to their specific needs.

The SBA's History and Evolution

SBA's rich history dates to its founding on July 30, 1953, under President Dwight D. Eisenhower. The Small Business Administration (SBA) was created to address the challenges facing small businesses in accessing capital and competing with larger companies.

Over the course of its history, the SBA has evolved to meet the needs of small businesses and the changing economic landscape. The program has played a vital role in helping entrepreneurs’ weather economic downturns, navigate government regulations, and access financing.

Throughout its history, SBA has offered a wide range of programs and initiatives. The services include loan guarantees, counseling, disaster relief, and government contracting support. The evolution of this industry reflects the recognition of small businesses as engines of economic growth and job creation.

Organizational structure of the SBA

Small businesses rely on the SBA's well-defined organizational structure for efficient delivery of its programs and services. As a government agency headquartered in Washington, DC, the SBA comprises various divisions and offices that collaborate to accomplish its goals.

The SBA's organizational structure includes the following components:

1. SBA's Office of the Administrator sets the agency's strategic direction and policies. Administrators oversee the agency's operations and ensure that its programs and initiatives are implemented effectively.

2. Office of Field Operations: The Office of Field Operations oversees the SBA's regional and district offices across the country. Small business owners can contact these offices for assistance, guidance, and access to SBA resources.

3. The Office of Entrepreneurial Development: provides small business owners with training, counseling, and educational resources. This agency oversees programs such as SCORE mentoring, Business Development Centers (BDCs), Women's Business Centers (WBCs), and Veterans Business Outreach Centers (VBOCs).4.

4. Capital Access: facilitates small business loans through loan guarantee programs. It manages a number of loan programs, including the flagship 7(a) Loan Program, Microloan Program, and CDC/504 Loan Program, which offer different options to meet the varied financing needs of small businesses.

5. The Office of Government Contracting and Business Development assists small businesses in navigating the government contracting landscape. Small businesses can secure government contracts through programs such as the 8(a) Business Development Program, HUBZone Program, and Women-Owned Small Business Program.

Understanding the SBA's organizational structure is crucial for small business owners. It helps them identify the appropriate channels for accessing resources and assistance.

III. The SBA's Small Business Programs and Services

The Small Business Loan Program

There are several loan programs offered by the Small Business Administration to help small businesses get access to capital. Programs include:

1. 7(a) Loan Program: This program is the SBA's flagship loan program and provides loans for working capital, equipment purchases, and expansions. Loans from the SBA are guaranteed, reducing lender risk, and enabling small businesses to access capital.

2. Microloan Program: This program provides small loans, typically up to $50,000, to entrepreneurs and small business owners. Borrowers are offered these loans through intermediary lenders and receive technical assistance.

3. CDC/504 Loan Program: The CDC/504 Loan Program provides long-term fixed-rate financing for major assets, such as real estate and equipment. SBA, Certified Development Companies (CDCs), and lenders work together on this program to offer small businesses affordable financing.

B. Disaster Assistance

During disasters, the SBA assists small businesses. Disaster assistance programs provide financial assistance and aid in recovery. There are several key programs, including:

· The SBA works with federal, state, and local agencies to help businesses recover from natural disasters, such as hurricanes, floods, and wildfires. Loans are provided at low interest rates for repairs, rebuilding, and replacing damaged property.

· The Economic Injury Disaster Loan (EIDL) is designed to support businesses that have suffered substantial economic damage because of a disaster. A recovery loan covers operating expenses and working capital requirements.

· Physical Disaster Loans: Physical Disaster Loans assist businesses with repairing or replacing damaged property, including equipment, inventory, and real estate, following a disaster.

C. Government Contracting Assistance

In addition to helping in accessing government contracting opportunities, the SBA also helps small businesses to secure loans from financial institutions. The following are key programs and initiatives:

· SBA's Guide to Government Contracting Opportunities: The SBA's guide to government contracts helps small businesses navigate the bid and contracting process.

· The 8(a) Business Development Program assists small businesses owned by socially and economically disadvantaged individuals. Program participants get access to government contracts set aside for program participants, as well as specialized training and counseling.

· The Historic Underutilized Business Zones (HUBZone) Program provides contracting opportunities for small businesses located in designated areas in order to promote economic development.

· This program provides contracting opportunities and resources specifically tailored to women-owned businesses in industries where they are underrepresented to support women entrepreneurs.

D. Counseling and Training Services

SBA offers counseling and training services to equip small business owners with the skills they need to succeed. Resources include:

· Small business owners receive free one-to-one counseling, mentoring, and advice from SCORE (Service Corps of Retired Executives).

· SBA Small Business Development Centers (SBDCs): SBDCs provide comprehensive business consulting, training programs, and assistance with developing a business plan for entrepreneurs.

· The Women's Business Centers (WBCs) provide training, counseling, and resources specifically tailored for women entrepreneurs, including business development workshops, access to capital, and networking opportunities.:

· VBOCs assist veterans, service-disabled veterans, and transitioning service members in starting, expanding, and transitioning their businesses. Veterans receive consulting, mentoring, and entrepreneurial development services tailored to their specific needs.

SBA programs and services support small businesses at all stages of development. With programs tailored to meet the needs of businesses, the SBA can assist in growth, disaster recovery, securing government contracts, counseling, and training.

IV. The SBA's Eligibility Requirements and Eligibility Criteria

A. Definition of a small business

It is essential to understand how the SBA defines a small business before diving into eligibility criteria. There is a wide range of sizes available from the SBA depending on the industry. Businesses are classified as small based on their number of employees or average annual revenue.

B. SBA Size Standards and Industry-Specific Guidelines

SBA size standards are used to determine whether a business qualifies as small. The amount of revenue, employees, or any other relevant metric varies across industries. Small businesses receive appropriate support and access to SBA programs based on these size standards.

On the SBA's official website, you can find the "Table of Small Business Size Standards" for determining if your business meets the SBA's size standards. Size standards are provided for various industries, including manufacturing, retail, and services.

C. SBA Program Documentation and Paperwork

SBA programs typically require certain documents and paperwork. The following documents may be required based on the program, but there are some that are common:

· Business plan: A comprehensive outline of your business, including details about your products or services, market analysis, financial projections, and growth strategies.

· Financial statements: This includes your balance sheet, income statement, and cash flow statement. These statements provide a snapshot of your business's financial health and stability.

· Tax returns: Personal and business tax returns for the past few years are often required to assess your financial standing.

· Legal documents: This may include business licenses, registrations, articles of incorporation, partnership agreements, and contracts.

· Personal background information: SBA programs may require information about the business owner's personal background, including resumes, personal financial statements, and credit reports.

· Collateral documentation: For loan programs that require collateral, you may need to provide documentation related to the assets being used as collateral.

D. Qualification Criteria for Different SBA Programs

The SBA has its own qualification criteria for its programs. SBA requirements may vary, but a few common factors are considered:

Business type: The SBA assists various types of businesses, including sole proprietorships, partnerships, LLCs, and corporations. It is important to know which programs are suitable for your business structure.

You should carefully review the specific eligibility criteria for the SBA programs you are interested in. Before applying, make sure you meet the requirements.

V. Applying for SBA Programs and Loans

A. Researching SBA Programs and Finding the Right Fit

You should research and understand the various SBA programs and loans before applying. The purpose, eligibility criteria, and benefits of each program differ. You should identify the program that best aligns with your business's specific needs, such as financing, disaster recovery, or government contracting. Visit the SBA website, contact local SBA offices or resource partners, and seek guidance from mentors or business advisors. This will ensure you make informed decisions.

B. Preparing the necessary documents and Financial Statements

Prepare the required financial statements and documents in advance to streamline the application process. The information usually includes business plans, financial statements (such as income statements, balance sheets, and cash flow statements), tax returns, legal documents, and background information. Review and update these documents to ensure accuracy and completeness. You may also need to prepare any additional documentation specific to the program you are seeking, such as project plans or certifications.

C. The Loan Application Process and Timeline

It is important to understand the timeline and requirements involved in the SBA loan application process. Here is a general overview.

-Complete the appropriate application form for the loan or program for which you are applying. Check for errors and omissions and provide accurate information.

-The application requires you to submit supporting documents and financial statements. Preparation and organization should be a priority.

-A review and processing of your application and documents will take place by the SBA and participating lenders. Business financials, creditworthiness, and eligibility may all be evaluated as part of this process. At this point, patience is essential, as making a decision can take time.

-Underwriting and approval: If your application meets the program's requirements and passes the review, it will move to the underwriting stage. The lender evaluates your creditworthiness, collateral, and repayment ability before approving your loan.

-After your application has been approved, you will work with your lender to complete the closing process, including signing loan documents and fulfilling any additional requirements. The funds will be disbursed in accordance with the terms of the agreement once the loan is closed.

D. Common Challenges and Tips for Successful Applications

It can be challenging to apply for SBA programs and loans. Here are some tips to help you succeed with your application:

1. Make sure you understand the eligibility requirements for the program for which you are applying. You should review your business’s finances and operations to ensure you meet the requirements.

2. Adequate preparation: Gather and organize all required documents and financial statements. Be sure they are accurate, up-to-date, and reflect your business's current situation. You can improve your chances of approval by preparing a well-organized application.

3. Financial viability: Lenders assess your business's financial health to determine your repayment ability. Your financial statements should demonstrate stability, profitability, and a positive cash flow. Consult an accountant or financial advisor if necessary.

4. Collateral and personal guarantees: Some SBA loans may require collateral or personal guarantees. Understand the collateral requirements and their impact on your business and individual assets. Your lender may require collateral or alternative options.

5. Persistence and follow-up: Stay engaged throughout the application process. Contact the lender or SBA representative to ensure the process is moving forward. Respond promptly to any additional inquiries or requests for information.

6. Consult a small business advisor, accountant, or attorney who can help you navigate the application process. Their expertise can help you navigate complex requirements, improve your application's quality, and increase your chances of success.

7. Be transparent and communicative: Maintain open and honest communication with the lender or SBA representative managing your application. You should inform them of any changes or updates to your business as soon as possible and provide any documentation that may be required. Clear communication can build trust and speed up the process.

8. Learn from feedback: If your application is not initially approved, don't be discouraged. To understand the decision reasons, ask the lender or SBA representative for feedback. Use this feedback to address any weaknesses or gaps in your application. Reapply after making the necessary improvements.

Understanding the SBA application process, preparing required documents, and addressing common challenges will improve your chances of success.

VI: Conclusion

The economy relies heavily on small businesses. The SBA plays a crucial role in the success of small businesses. The Small Business Administration provides entrepreneurs with capital, skills development, disaster recovery, and government contracting services. We encourage small business owners to explore SBA programs and take full advantage of the available resources. With SBA assistance, small businesses can increase their chances of growth, sustainability, and long-term success.

Despite the challenges of entrepreneurism, the SBA and its resource partners are here to help you. Continue to innovate and adapt and seek guidance when necessary. A small business can have a significant impact on the economy and those you serve.

Sign up for the newsletter and get our latest stories delivered straight to your inbox.