Green is the New Black: Why the GGRF Matters to Your Small Business

What if you could significantly reduce your operating costs? Then imagine if you could attract a new wave of environmentally

Empower your small business growth with asset-based lending. Discover how leveraging your assets can unlock flexible financing solutions and fuel your business potential.

Are you a business owner who feels restricted by the limited financing choices available? Have you discovered conventional lenders struggle to grasp the requirements and obstacles of your entrepreneurial path? If that's the case, it might be worth looking into the advantages of asset-based lending.

As an asset-based lending expert with over two decades of experience, I've witnessed firsthand how this innovative financing solution can unlock exponential growth. It adds to the financial flexibility entrepreneurs need to thrive. Asset-based lending is a much-needed breath of fresh air. This is very important since small businesses often struggle to get funding from conventional sources.

By using the value of your current assets, you can secure the funds needed to take advantage of new opportunities, expand your operations, and boost your business to greater success. It's a game-changer that empowers you to dictate your growth trajectory, unshackled by the limitations of traditional lending practices.

We will explore the many facets of asset-based lending to empower you to make smarter and more informed financing decisions. So, mute your mobile phone, tell your assistant to hold the calls, and let's dive in!

Asset-based lending is a method of financing that uses your business's assets, like accounts receivable, inventory, equipment, or real estate, as security to obtain funding. Unlike bank loans, which focus heavily on your credit and financial records, asset-based lenders prioritize the quality and worth of your assets.

This paradigm shift opens new avenues for small businesses that may have faced roadblocks when seeking financing through conventional channels. You can access the capital needed for your growth ambitions by tapping into the equity in your existing assets. This will also help you bridge cash flow gaps or seize time-sensitive opportunities.

Traditional lending methods prioritize historical financial performance. Conversely, asset-based lending looks to the future. It enables you to capitalize on your company's potential. It's a flexible financing solution. It adapts to the ever-changing dynamics of your business. It provides a lifeline when you need it most.

The beauty of asset-based lending lies in its ability to unlock the value hidden within the very assets that power your business operations. From the invoices awaiting payment to the inventory lining your shelves, and the equipment humming on your production floor, each of these assets represents a potential source of financing.

Accounts Receivable: The bread and butter of many asset-based lending facilities, your accounts receivable represent the outstanding invoices owed to your business by customers. By leveraging these receivables as collateral, you can access the cash tied up in unpaid invoices, alleviating cash flow constraints and fueling your growth initiatives.

Inventory: For businesses that rely on substantial inventory holdings, whether it's raw materials, work-in-progress, or finished goods, these tangible assets can serve as collateral for an asset-based loan. By tapping into the value of your inventory, you can free up working capital to replenish stock, ramp up production, or explore new product lines.

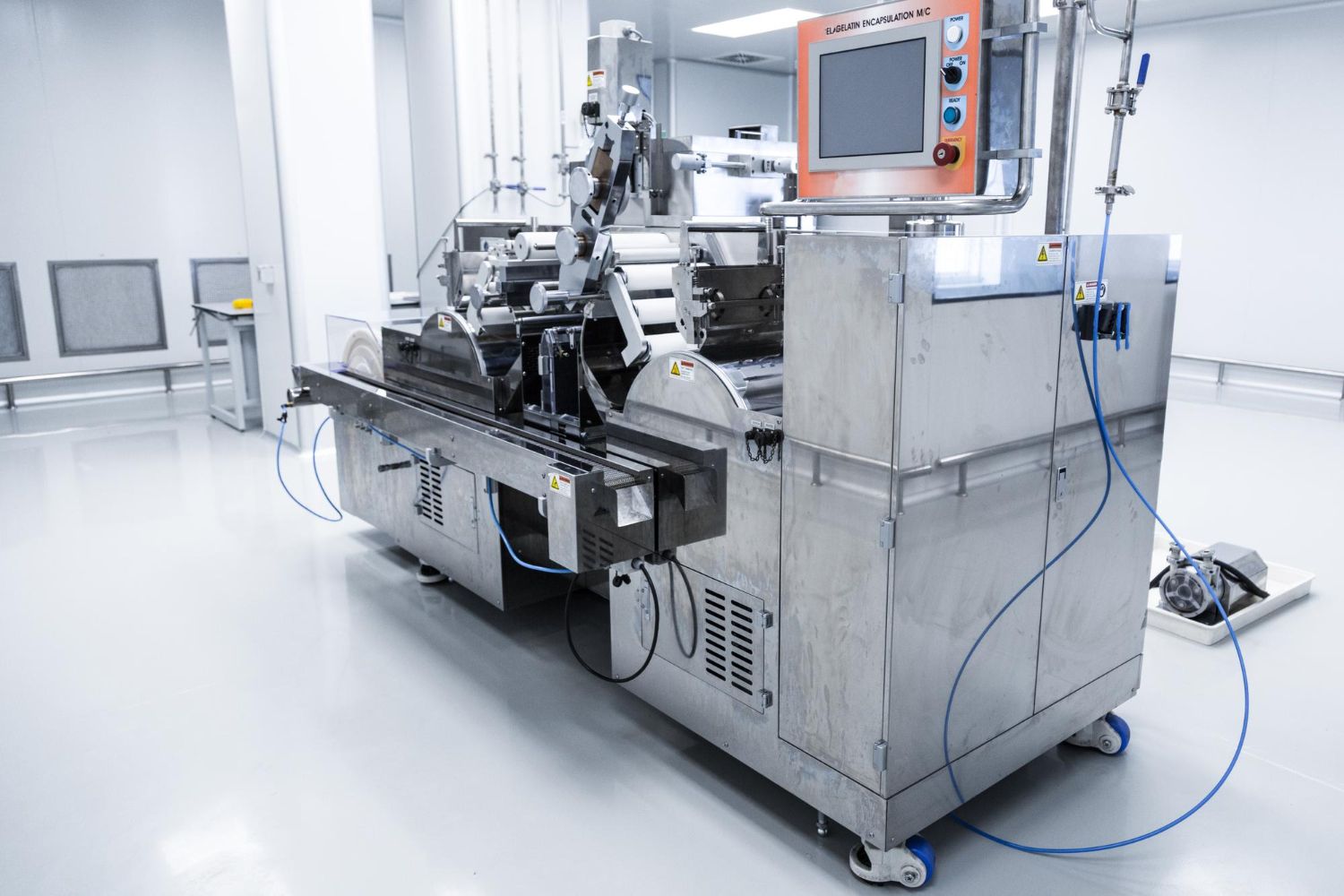

Equipment: The machinery, vehicles, and other equipment essential to your operations can also be utilized as collateral in an asset-based lending arrangement. This approach enables you to leverage the value of your existing equipment to secure funding for expansions, upgrades, or the acquisition of new assets, all without relinquishing ownership.

Real Estate: If your business owns commercial real estate, such as office buildings, warehouses, or production facilities, these valuable assets can be leveraged to secure asset-based financing. This option empowers you to access the equity tied up in your real estate holdings, unlocking capital for business growth, renovations, or strategic acquisitions.

By recognizing the inherent value in these diverse asset classes, asset-based lenders provide small businesses with a flexible and comprehensive financing solution tailored to their unique needs and asset portfolio.

Asset-based lending has a major advantage. It can ease the cash flow limits that often hurt small businesses. You can use your existing assets as collateral. This lets you access the working capital needed to bridge the gap between receivables and payables. It ensures a steady flow of funds for daily operations, growth initiatives, or new opportunities.

Imagine having the financial flexibility to pay suppliers on time, meet payroll obligations, and still have capital on hand to fund your expansion plans. Asset-based lending empowers you to do just that, providing a lifeline when traditional financing sources fall short or are simply too inflexible to meet your needs.

As a small business owner, you understand the importance of adaptability. You are constantly facing ever-changing market conditions. Then there are seasonal fluctuations, the economy, and evolving customer demands. Asset-based lending offers the flexibility and scalability required to navigate these challenges with ease.

Rigid conventional financing struggles to accommodate shifts in your business. But asset-based lending can be tailored to your needs. It can grow or shrink with your operations. Need additional funding to meet a surge in demand? Your asset-based loan can be adjusted accordingly. Facing a seasonal slowdown? The facility can be scaled back to match your reduced asset levels, minimizing unnecessary borrowing costs.

This unmatched flexibility ensures that your financing stays aligned with your business's realities. It empowers you to scale operations smoothly, seize new opportunities, and keep a competitive edge in a changing marketplace.

For many small business owners, the prospect of relinquishing equity and decision-making power in exchange for financing can be a daunting proposition. Asset-based lending offers a compelling alternative, empowering you to access the capital you need without sacrificing ownership or control over your hard-earned enterprise.

Unlike equity financing, where investors acquire a stake in your company, asset-based lending allows you to retain full ownership and autonomy. You remain the captain of your ship, charting the course for your business's future without external interference or the need to answer to shareholders with potentially conflicting interests.

This dynamic not only preserves your entrepreneurial freedom but also ensures that the fruits of your labor remain firmly in your hands. As your business grows and thrives, the rewards of that success are yours to reinvest or distribute as you see fit, without the complications of divided ownership.

Embarking on the asset-based lending journey requires careful preparation to ensure a smooth and successful experience. The first step involves assessing the eligibility of your assets for use as collateral. Lenders will evaluate factors such as asset type, age, condition, and marketability to determine their suitability for inclusion in the lending facility.

Next, you'll need to gather the necessary documentation to support your application. This typically includes financial statements, asset listings, accounts receivable aging reports, and other relevant records that demonstrate the value and quality of your assets.

Perhaps most crucially, you'll need to choose the right asset-based lender for your business. This decision should be guided by factors such as the lender's industry expertise, reputation, and track record of working with small businesses. Additionally, consider their flexibility in structuring facilities, competitive pricing, and overall commitment to supporting your growth objectives.

Once you've selected a lender and submitted your application, the underwriting process begins. During this phase, the lender will conduct a thorough evaluation of your assets, including physical inspections, market valuations, and rigorous risk assessments.

The asset valuation and monitoring process is critical, as it determines the borrowing base – the maximum amount of funding you can access based on the value of your eligible assets. Lenders will closely monitor asset quality and performance throughout the lending relationship to ensure the continued viability of the facility.

Risk assessment is another integral component of the underwriting process. Lenders will scrutinize factors such as industry dynamics, market conditions, and your company's overall financial health to gauge the potential risks associated with extending financing.

Based on these evaluations, the lender will structure the asset-based lending facility, determining factors such as advance rates, interest rates, fees, and other terms tailored to your specific circumstances and risk profile.

Once your asset-based lending facility is in place, ongoing management and compliance become paramount to ensure a successful and enduring partnership with your lender.

Regular reporting and monitoring are essential, as lenders will require periodic updates on your asset levels, performance, and overall financial health. Maintaining asset quality is critical, as any deterioration in the value or condition of your collateral assets could impact the borrowing base and your access to capital.

As your business evolves and your financing needs change, you may need to explore options for renewing or refinancing your asset-based lending facility. Proactive communication with your lender and careful consideration of your long-term growth objectives will be key to ensuring a seamless transition and continued access to the capital you need.

Asset-based lending has become a powerful tool for small businesses. It gives them financial flexibility, better cash flow management, and the ability to grow without giving up equity or control. The financial landscape is always changing. Small business owners must explore new ways to finance that fit their unique needs and growth goals. By using their existing assets, small businesses can unlock their full potential and navigate the challenges of today's competitive marketplace with confidence.

A. Asset-based lending is frequently a beneficial option for businesses that possess substantial assets like accounts receivable, inventory, equipment, or real estate. Sectors that typically find asset-based lending advantageous include manufacturing, distribution, wholesale trade, and service-oriented enterprises with significant receivables.

A. In the traditional banking system, the emphasis is usually on the borrower's credit history and financial documents, whereas asset-based lending places more importance on evaluating the worth and quality of the borrower's assets. This method offers more flexibility and funding opportunities for companies with substantial assets but lower creditworthiness or cash flow.

A. Asset-based lending arrangements commonly include a range of charges and fees like initiation fees, investigation fees, maintenance fees, and interest payments. The specific costs may fluctuate based on the lender, the extent of the facility, and the borrower's risk level. It's crucial to thoroughly assess and contrast the expenses associated with various asset-based lending choices.

A. To stay compliant with an asset-based lending facility, small businesses usually need to submit reports regularly, keep an eye on the quality of their assets, and meet the conditions and terms set by the lender.

Small businesses need to have strong processes for keeping track of and handling their assets, along with maintaining good communication with their lender to handle any problems or adjustments in their business activities effectively.

A. While asset-based lending can provide valuable short-term financing and bridge gaps in working capital, it can also be a viable long-term solution for small businesses with consistent asset generation and growth plans.

Many lenders offer renewable and refinanceable facilities, allowing businesses to maintain access to capital as their asset base evolves over time.

Sign up for the newsletter and get our latest stories delivered straight to your inbox.